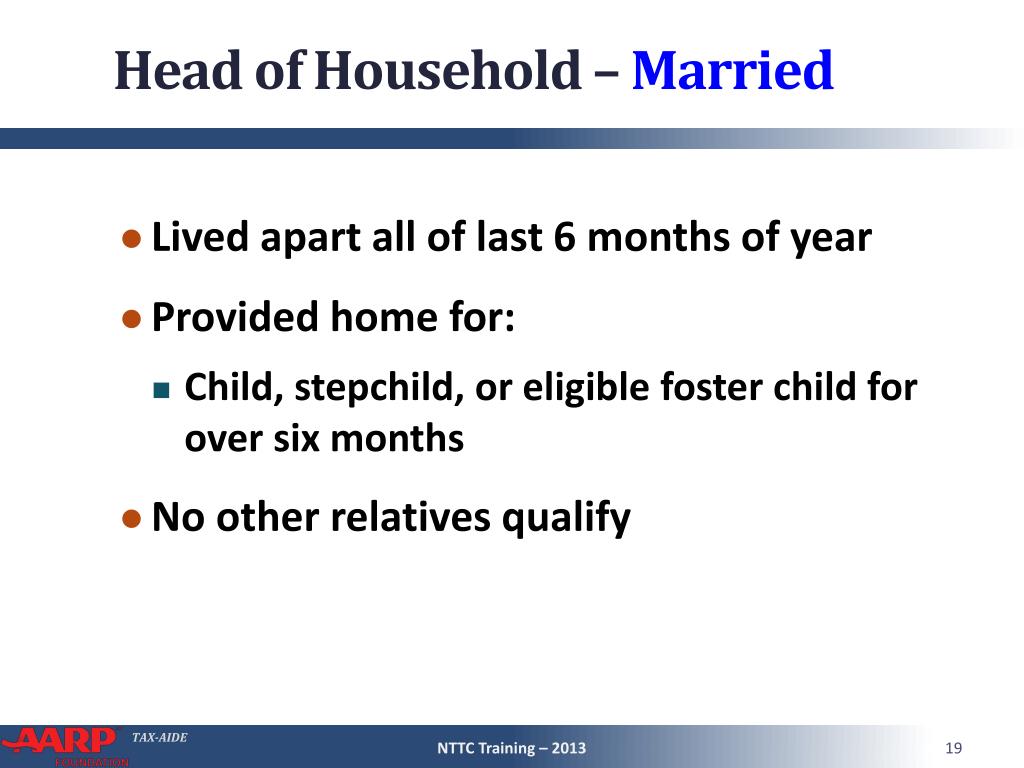

Define Head Of Household Married . Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. For a taxpayer to qualify as head of household, he/she. Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web the head of household is a tax filing status for individuals living in the united states. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household.

from www.slideserve.com

Web the head of household is a tax filing status for individuals living in the united states. Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. For a taxpayer to qualify as head of household, he/she. Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs.

PPT Filing Status PowerPoint Presentation, free download ID4091603

Define Head Of Household Married Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. For a taxpayer to qualify as head of household, he/she. Web the head of household is a tax filing status for individuals living in the united states. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household.

From www.youtube.com

How To Fill Out Form W4 2024 Single, Head of Household, Married Define Head Of Household Married Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web the head of household is a tax filing status for individuals living in the united states. Web. Define Head Of Household Married.

From www.youtube.com

What happens if I file head of household while married? YouTube Define Head Of Household Married Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. Web the head of household is a tax filing status for individuals living in the united states. Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web. Define Head Of Household Married.

From www.pinterest.com

Mikkel Paige Photography Colorful Luxury + Destination Weddings Define Head Of Household Married Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. Web head of household is a tax filing status for unmarried people with qualifying dependents who were. Define Head Of Household Married.

From www.grammarbank.com

Family Tree Relationship Names in English Define Head Of Household Married Web the head of household is a tax filing status for individuals living in the united states. For a taxpayer to qualify as head of household, he/she. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web for irs purposes, a head of household. Define Head Of Household Married.

From slideplayer.com

Paychecks and Tax Forms Take Charge of your Finances ppt download Define Head Of Household Married Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web the head of household is a tax filing status for individuals living in the united states. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay. Define Head Of Household Married.

From www.thebestpaystubs.com

Qualifying as Head of Household Requirements and Benefits Define Head Of Household Married Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. For a taxpayer to qualify as head of household, he/she. Web the head of household is a tax filing status for individuals living in the united states. Web the head of household status gives unmarried taxpayers who support and house a. Define Head Of Household Married.

From www.jyfs.org

Head of Household vs. Single The Differences Explained The Knowledge Hub Define Head Of Household Married Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web the head of household is a tax filing status for individuals living in the united states. Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. For. Define Head Of Household Married.

From www.jyfs.org

Head of Household vs. Single The Differences Explained The Knowledge Hub Define Head Of Household Married Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web the head of household is a tax filing status for individuals living in the united. Define Head Of Household Married.

From www.jyfs.org

Head of Household vs. Single The Differences Explained The Knowledge Hub Define Head Of Household Married Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web the head of household is a tax filing status for individuals living in the united states. Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable.. Define Head Of Household Married.

From www.aboutflr.com

A woman's guide to the benefits of a Female Led Relationship AboutFLR Define Head Of Household Married Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web the head of household is a tax filing status for individuals living in the united states. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay. Define Head Of Household Married.

From www.simplifycomplexity.org

What does it Mean to be Head of Household? Simplify Complexity Define Head Of Household Married Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents. Define Head Of Household Married.

From www.slideserve.com

PPT Filing Status PowerPoint Presentation, free download ID4091603 Define Head Of Household Married Web the head of household is a tax filing status for individuals living in the united states. Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay. Define Head Of Household Married.

From www.jyfs.org

What’s the Difference Between Single and Head of Household? The Define Head Of Household Married Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. Web the head of household is a tax filing status for individuals living in the united states.. Define Head Of Household Married.

From www.youtube.com

What is a Head of Household? Tax Lingo Defined YouTube Define Head Of Household Married Web the head of household status gives unmarried taxpayers who support and house a dependent a more favorable. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web the head of household is a tax filing status for individuals living in the united states.. Define Head Of Household Married.

From twitter.com

IRSnews on Twitter "Your filing status helps determine several things Define Head Of Household Married Web for irs purposes, a head of household is generally an unmarried taxpayer who has dependents and pays for more than half the costs. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web head of household is a tax filing status for unmarried. Define Head Of Household Married.

From www.chegg.com

Status Married, joint Single or head of household Define Head Of Household Married Web the head of household is a tax filing status for individuals living in the united states. For a taxpayer to qualify as head of household, he/she. Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. Web the head of household status gives unmarried taxpayers who support and house a. Define Head Of Household Married.

From www.pinterest.jp

father submits to God. father is the head of household. wife is the Define Head Of Household Married Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web the head of household status gives unmarried taxpayers who support and house a dependent a. Define Head Of Household Married.

From dailycitizen.focusonthefamily.com

Just 18 of American Households Are Families with Married Parents Define Head Of Household Married Web head of household is a tax filing status for unmarried people with qualifying dependents who were responsible for. For a taxpayer to qualify as head of household, he/she. Web according to the internal revenue service (irs), to qualify for head of household, you must be unmarried, pay for more than 50% of household. Web the head of household status. Define Head Of Household Married.